In 2014, Financial Sector Deepening Zambia and Microfinance Opportunities (MFO) began the Zambia Financial Diaries—a 52-week study of the financial lives of 352 low-income Zambians. The study included 92 smallholder farmers—individuals who own small plots of land on which they grew crops or tended livestock for sale and/or subsistence.

The Zambian smallholder farmers represent only a tiny fraction of the estimated 500 million smallholder households worldwide. Smallholder farmers are a large livelihood group and addressing their diverse needs—from crop diversification to market integration—is a strategic priority for the World Bank Group, country-level governments, and non-government organizations.

Understanding smallholder farmers’ income patterns is critical for designing financial services that meet their financial needs. The common perception of farmers’ income patterns is that they are lumpy and linked to agricultural cycles, but the income patterns identified in MFO’s Zambia Financial Diaries challenge this perception.

Income Patterns

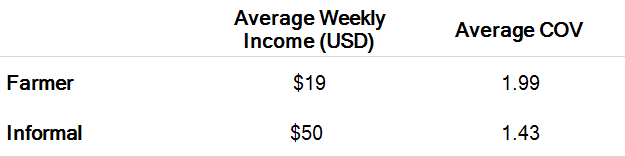

The farmers in MFO’s study had lower and more variable incomes than respondents who earned the majority of their income from informal, off-farm sources (“informal workers”). The farmers had 4.3 income sources on average, often relying on casual labor or running informal shops to supplement their agricultural activities, while informal workers had 3.3 sources. Farmers’ average weekly earnings were low—only about $19 per week on average compared to $50 informal workers (based on June 2015 exchange rates). The farmers also experienced more week-to-week income variation, as measured by the coefficient of variation (COV), than other respondents who work in the informal economy.

Figure 1: Income Patterns for Farmers and Informal Workers

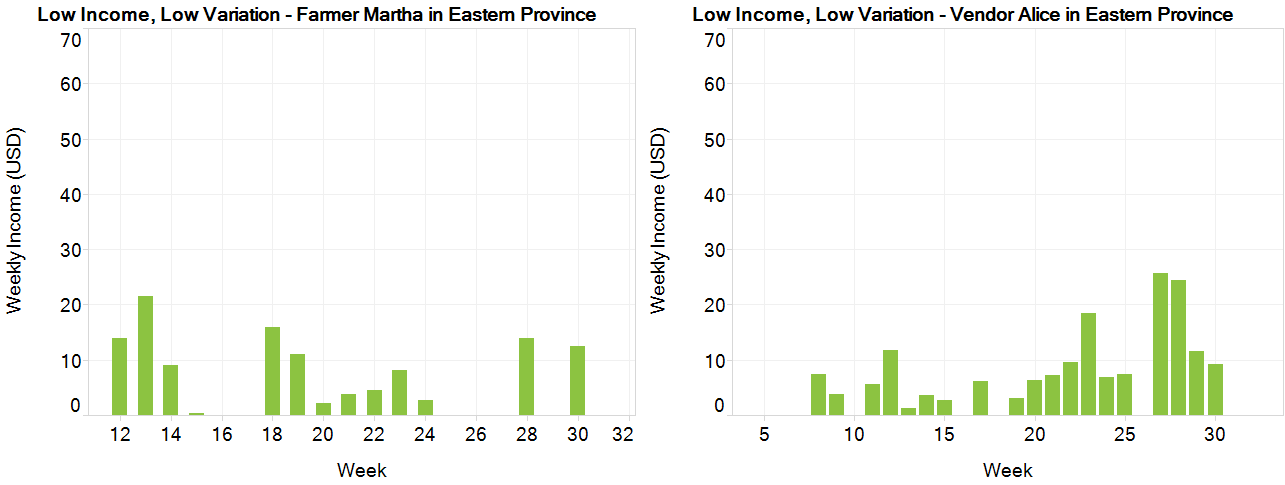

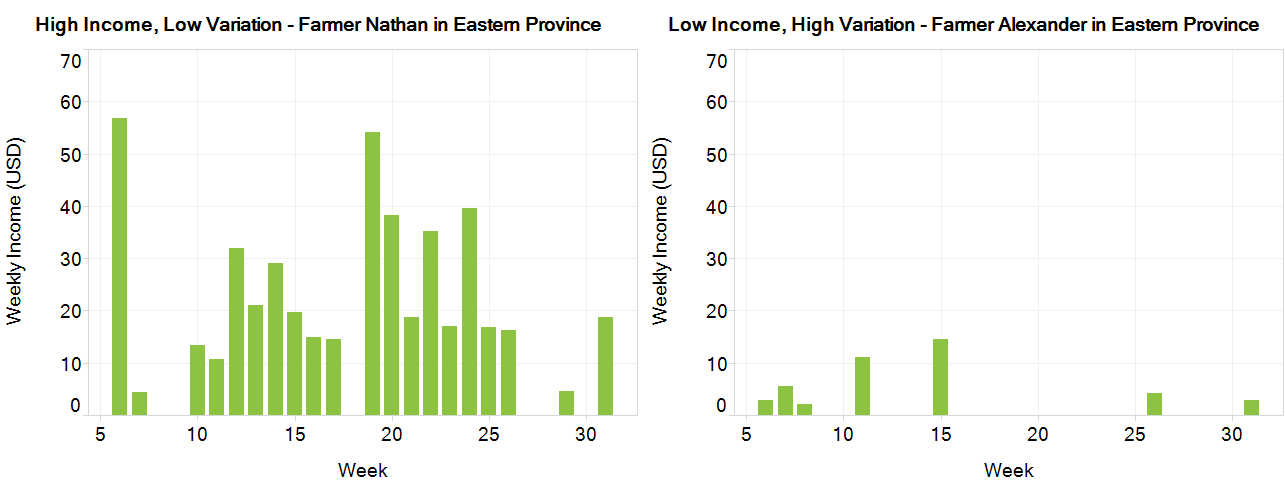

However, these data mask the diversity of smallholder farmers’ income patterns. The study found farmers who earned large sums frequently, while others had large and inconsistent windfalls. Lower-income farmers also had diverse patterns, with some earning small sums on a frequent basis while others went weeks between earning income.

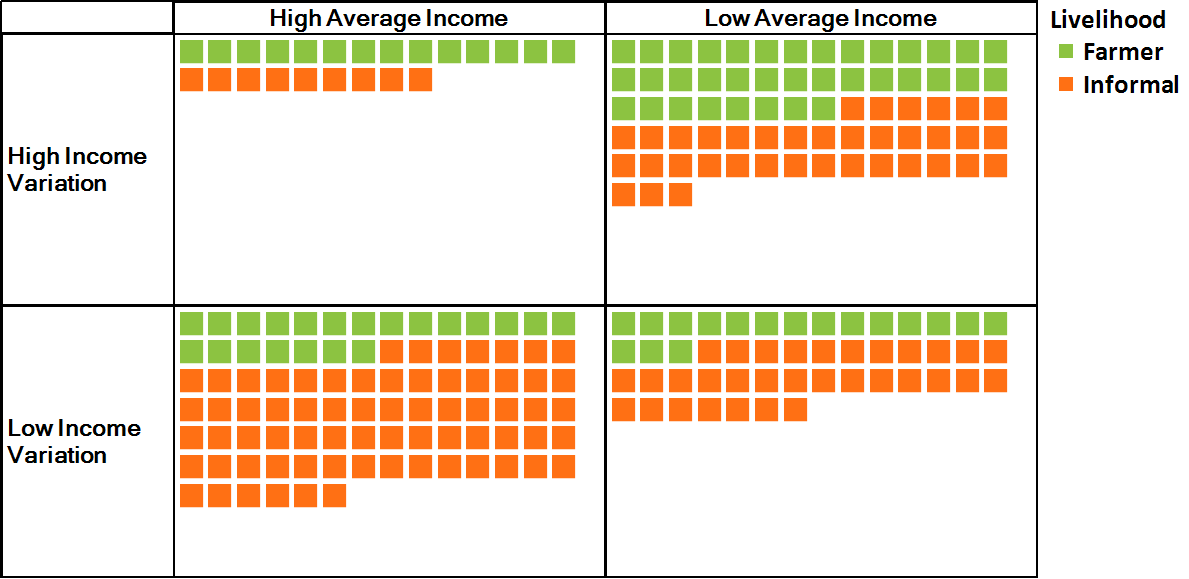

Figure 2: Farmers with Differing Income Patterns

MFO developed a simple market segmentation framework to understand the role of income patterns in financial service design better. The framework comprises two dimensions: average weekly income and week-to-week income variation as measured by the COV. We divided respondents into high- or low-income groups at the median of average weekly income and high- or low-variation groups at the median of the COV.

Figure 3: Income Segmentation Framework

Implications of Segmenting by Income Behavior

The segmentation framework demonstrates the diversity of smallholder farmers’ income patterns and their similarity to the income patterns of informal workers. This finding should encourage stakeholders to prioritize collecting information about consumers’ income patterns when designing financial services for the low-income market segment. The financial needs of a smallholder farmer with high, steady income are more similar to those of a micro-entrepreneur with the same income pattern than a smallholder farmer who irregularly earns small sums. Recognizing these inter-livelihood similarities can help stakeholders mitigate inefficiencies in the design, marketing, and delivery of financial services.

Figure 4: Farmer and Vendor with Similar Income Patterns

Stakeholders focused specifically on smallholder farmers should consider the needs and opportunities that these income patterns suggest. For instance, a farmer with high income and high variation may benefit from interventions that allow the farmer to diversify on- and off-farm income sources. This diversification could lead to more consistent annual income. A farmer with high income and low variation may be best suited for interventions that support the expansion of farming activities through asset financing or linkages with local markets. Farmers with low income and high variation may struggle to piece together the income necessary to purchase inputs during the planting season; thus, a layaway product might be beneficial for them. Cash transfers from government agencies or non-governmental organizations would help farmers with low income and low variation pay basic on- and off-farm expenses that their meager earnings cannot cover.

Income patterns alone should not inform the design of financial services for smallholder farmers, but they are a critical component in the process. MFO’s hope is that this study and other research can help improve the efficacy of interventions meant to help this diverse group.

For more information on the research methodology and additional findings, please read the Zambia Financial Diaries Interim Report.